Accrue Pay by Wallet

Pay by Wallet allows a merchant to offer the Accrue Savings Wallet as an alternative to pay for goods and services directly in the merchant app or website. Funds are transferred from the customers Accrue Savings Wallet to the merchant on a settlement schedule agreed upon by the merchant and Accrue, saving the merchant fees from payment processors.

For further implementation detail view the Settlements Guide, Mobile Integration Guide and the Web Integration Guide.

How it works

Consumer Flow

-

Consumer creates an Accrue Saving wallet

The user opens up a wallet where they can continuously make deposits towards future purchases with a Merchant. They are incentivised to save via rewards for every deposit at a rate agreed upon between Accrue and the merchant.

-

Consumer funds their wallet

Accrue Savings provides multiple ways to help the user fund their merchant wallet - ACH, Debit card, contributions, round ups and other funding features. Accrue uses techniques such as gamification, goal setting, loss aversion, leveling up and incentive periods to keep the user saving.

-

Consumer initiates payment at merchant checkout

In order to use their saved funds, the consumer can choose to use Accrue Pay at checkout and log in to their account from the merchant site directly. If the user does not have sufficient funds save in their Accrue Wallet, they can supplement the full purchase price by linking an external bank account to cover the balance.

A user must have a funded Accrue Savings wallet for the merchant prior to checkout.

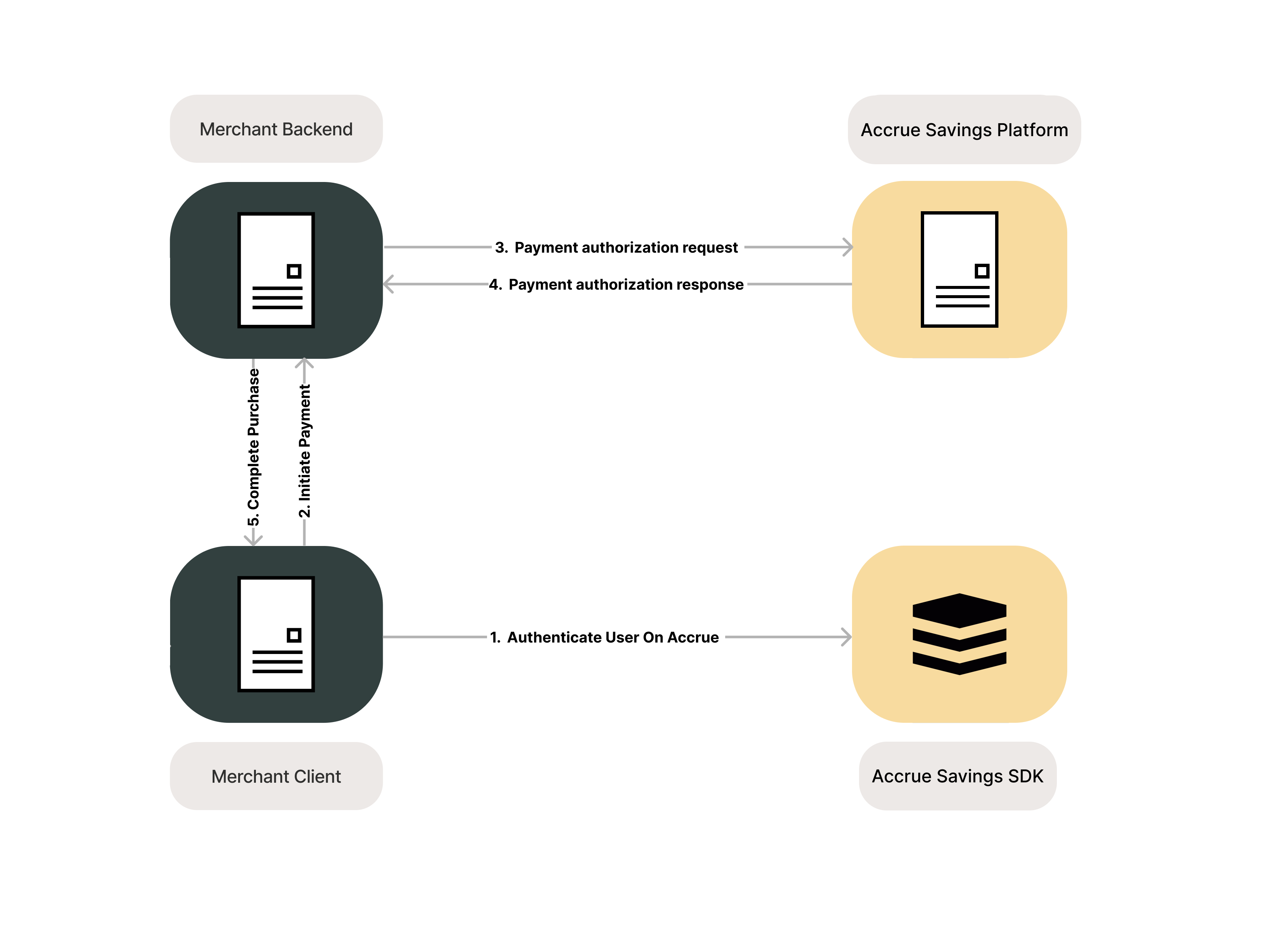

Merchant Flow

Once consumer initiates payment at checkout, merchant should do the following:

-

Merchant initiates payment flow

The merchant can initiate the payment flow by calling the Accrue Merchant API to authorize the payment.

-

Merchant fetches card details

Once payment is authorized, the merchant can fetch the card details from the Accrue Merchant API and can process the payment using their existing payment processor.

-

Merchant processes payment

Once the payment is processed by your payment processor, call the complete payment endpoint to complete the payment, or if the payment is declined, call the cancel payment endpoint to cancel the payment.

Once the payment is complete, we will settle the funds from the consumer's Accrue Savings Wallet to the merchant's bank account on a schedule agreed upon between the merchant and Accrue.

Implementation is quick and easy. Add a few lines of code to your checkout screen or page and get started.

Flow diagram