Merchant API Integration

- Once you have integrated Accrue Pay into your Mobile or Web App, you'll be able to Authorize Payments or Capture Payments on your backend.

- To facilitate this we are providing you with access to our

Merchant API, for which you'll receive aClient IDand aClient Secret - We'll provide you with additional credentials to access the

Sandbox APIthat you can use in your development environments.

Making requests to the Merchant API

- For a complete overview please refer to the Merchant API Reference.

- Our API is designed utilizing the REST paradigm.

- All requests are HTTP requests. Each request can be one of the following methods:

GET,POST,DELETE,PUTandPATCH. - A successful request will return a response in the JSON:API v1.1 specification.

API URLs

- The Live version is available at

https://merchant-api.accruesavings.com - The Sandbox version is available at

https://merchant-api-sandbox.accruesavings.com

Authentication

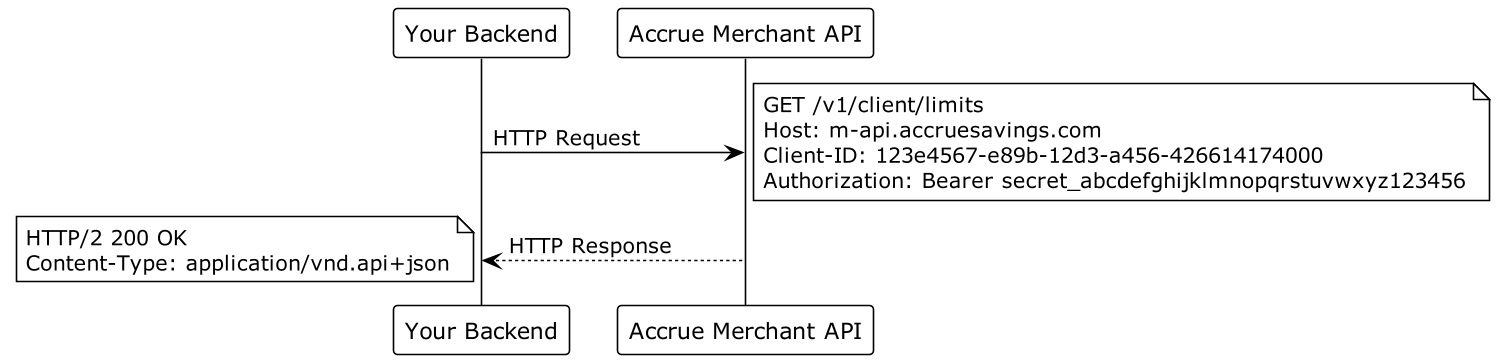

Private Requests

- Private requests can only be made by including your

Client Secret, alongsideClient IDin request headers. - Private requests should never be made from user-facing apps, like Mobile Apps and Web Apps.

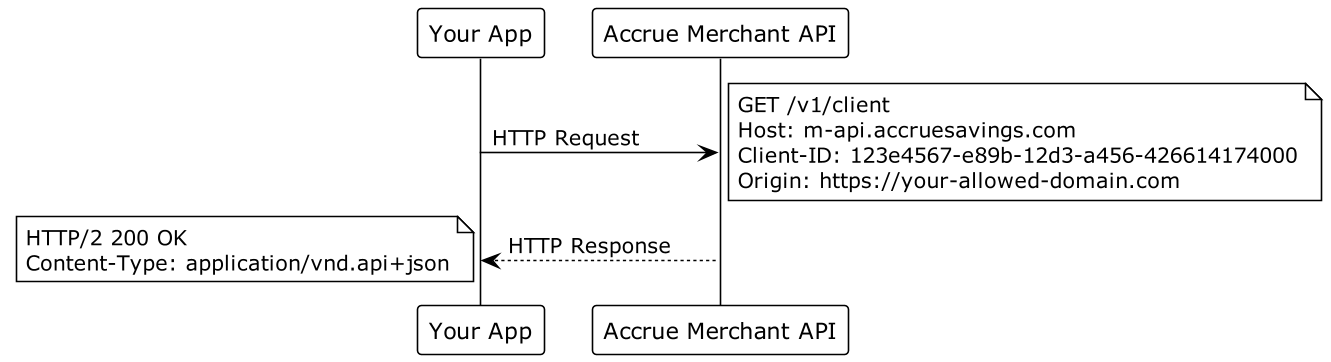

Public Requests

- Public requests can be made from user-facing apps by including your

Client IDin request headers. - Only a few endpoints are available to be publicly requested.

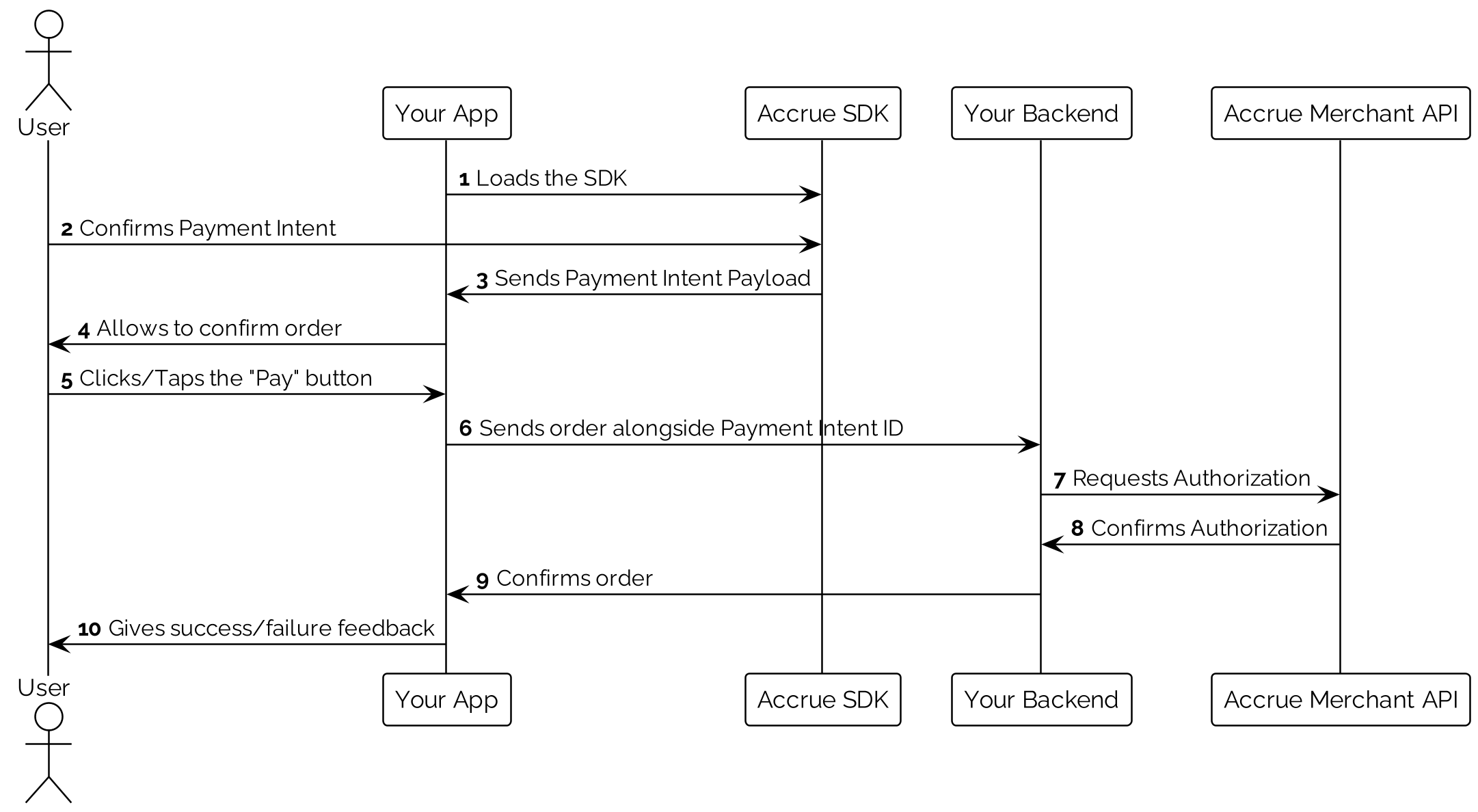

Payment Intent Flow

- Once you have successfully integrated Accrue Pay into your Mobile App, or Web App, you'll start forwarding

Payment Intentsto your backend. - A Payment Intent is an object that keeps track of User's choices made on your checkout page/screen and ultimately represents a payment method.

- A

Payment Intentcan bepromotedto aPayment. Each time you promote an intent, a newPaymentwill be authorized and created. - Once a

Paymenthas been created you canincrease-authorization,captureorcancelthat payment.

End-to-End Integration

Payment Authorization and Capture via Bank Rails

-

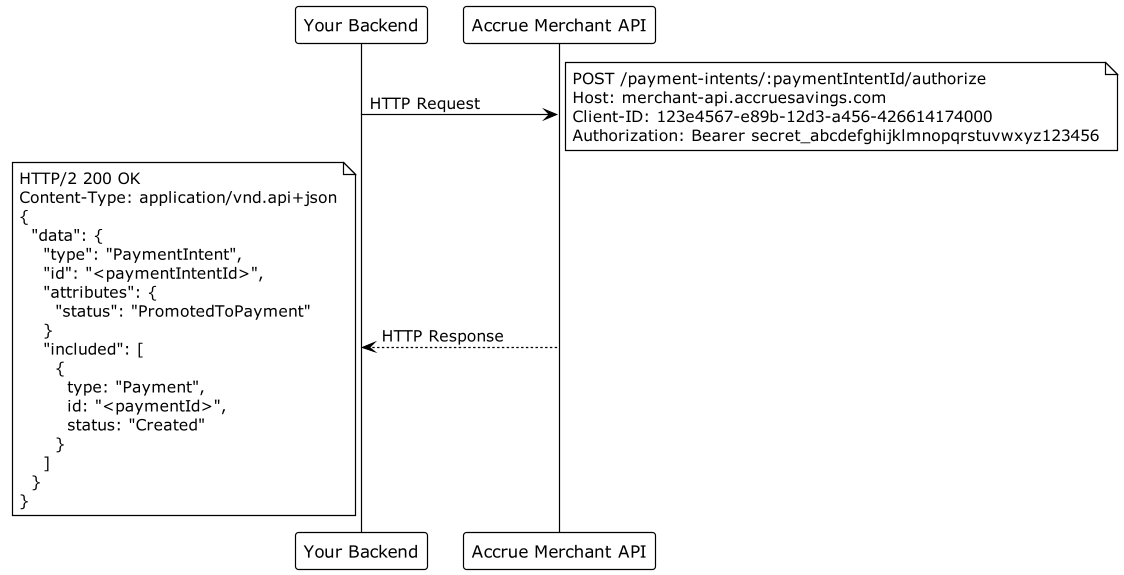

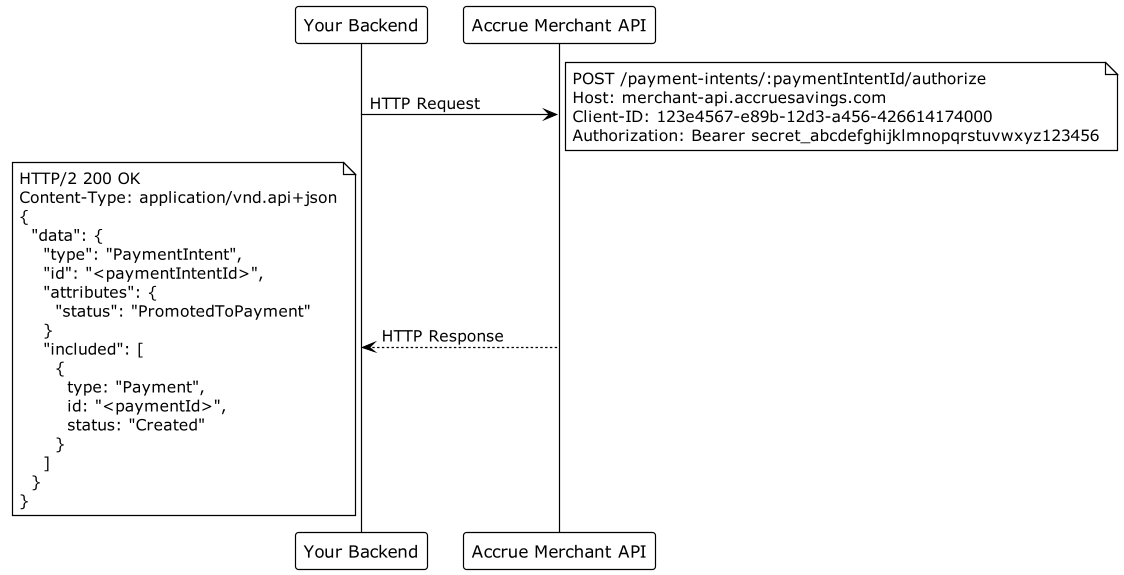

First promote a

Payment Intentto aPayment, using thePOST:/payment-intents/:paymentId/authorizeendpoint:

-

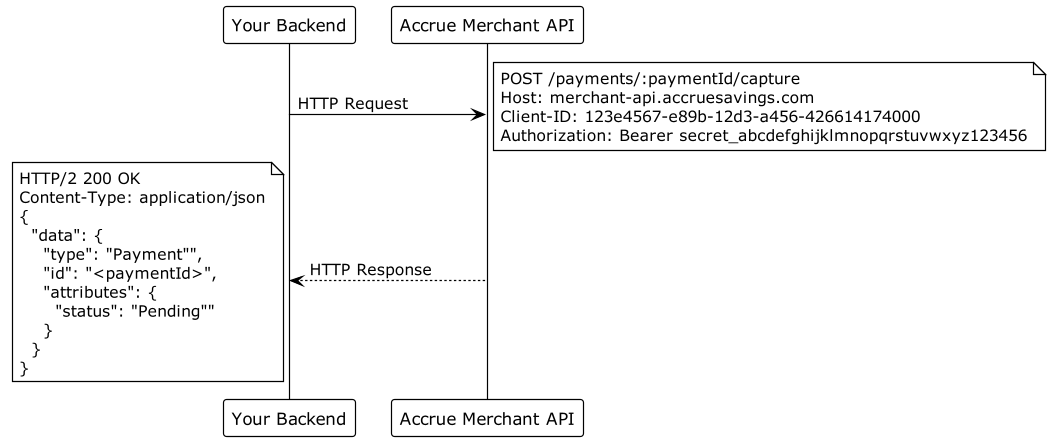

Once you are ready to capture the payment call the

POST:/payments/:paymentId/captureendpoint:

-

Once you capture the payment, funds should be cleared into your bank account at the soonest possible time.

Payment Authorization and Capture via Card Rails (Virtual Debit Cards)

- First promote a

Payment Intentto aPayment, using thePOST:/payment-intents/:paymentId/authorizeendpoint:

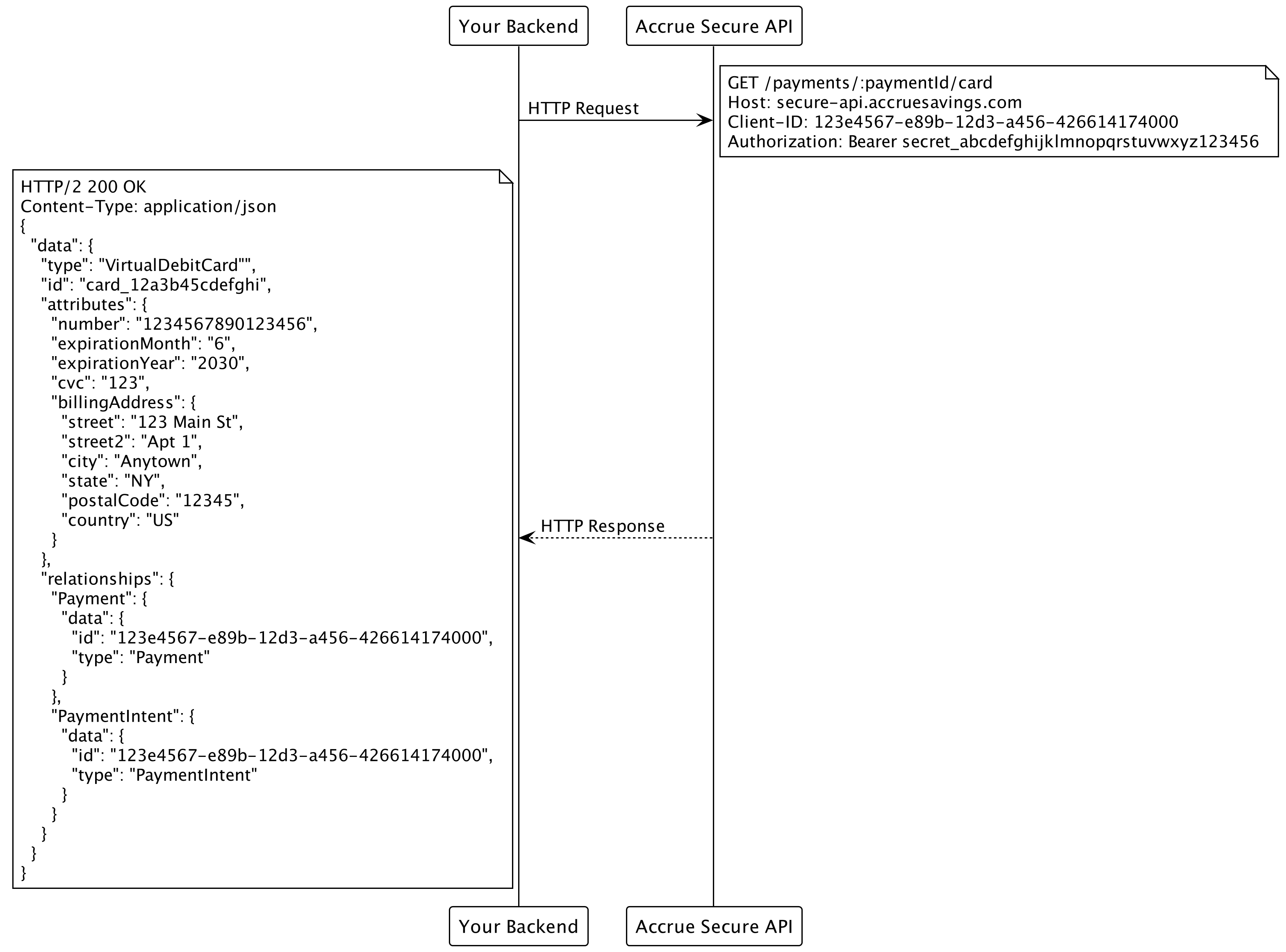

- Retrieve the card details using our special API for fetching cards securely

GET:https://secure-api.accruesavings.com/api/v1/payments/:paymentId/card:

- Use the retrieved

Virtual Debit Cardto capture the payment through any payment gateway that acceptsMasterCard.

Full API Reference

All available requests with descriptions and examples are available here: Merchant API Reference.